January 31, 2023

Recent 401(k) and IRA changes could have a significant impact on your personal finances and retirement savings, and it’s worth reassessing your savings plan. In December of 2022, President Biden signed the Secure 2.0 Act of 2022, a bipartisan retirement savings law that includes numerous retirement policy changes that will go into effect over the […]

January 27, 2023

Businesses are hiring contract workers at a record rate to help with all aspects of the business. Despite increasing regulations on contractors and freelancers, a tight labor market is giving individuals the opportunity to showcase their expertise exactly where they want. A recent Gusto study shows that in the last two years contractor payments have […]

January 19, 2023

It’s officially tax season, and that means many small business owners are scrambling to clean up their books from the previous year in order to hand information over to their tax preparers. While some small business owners dread this time of the year, others have taken control of their books and are prepared. But what […]

January 18, 2023

Roth conversion (converting from a Traditional to a Roth IRA) can be an attractive prospect when the market is down; you can move your balance to the Roth IRA while the taxable amount is lower and then let it grow tax-free in the Roth account. There are various reasons to convert a Traditional IRA to […]

January 12, 2023

Financial Solution Advisors believes in supporting our team, clients, and community—whether that be through financial planning, tax preparation, business finances, career growth, or charitable events to support those in need. FSA hosts events throughout the year that benefit charitable organizations in the community that are near and dear to our hearts. These events bring our […]

January 10, 2023

Any financial planner worth their salt will not simply sell you financial products, review your portfolio, or conduct an insurance analysis or retirement assessment. Of course, these elements are essential parts of a financial plan, but by no means do they represent the whole. The core of your financial plan is you—not the products, services, […]

January 3, 2023

As businesses all over the world continue to see benefits from remote work arrangements, many are still scrambling to add the necessary technology their teams need to keep the business running. Cloud accounting offers ways to boost your bottom line and pave the way for future growth—and now it’s critical to ensure you can pay […]

December 20, 2022

The Work Opportunity Tax Credit (WOTC) is available to employers that hire individuals from targeted groups that have traditionally faced barriers to employment. For each WOTC-eligible employee hired, you’ll be able to reduce your federal tax liability. The WOTC is one of the most underutilized tax credits available to businesses. Read on to find out […]

December 8, 2022

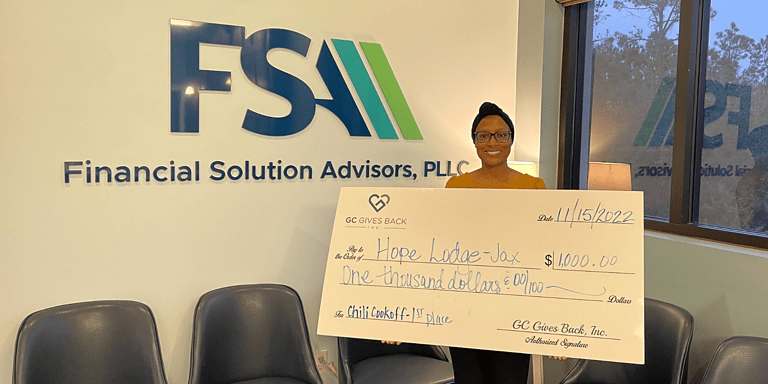

In the spirit of giving back to the Jacksonville community while also having a little competitive fun, we recently hosted a shred-fest and chili cook-off. At the event, participants and our team members were able to reduce the risk of identity theft by destroying old documents. In order to make sure nobody went home hungry, […]

December 7, 2022

These days, it’s not uncommon for at least part of your home to double as office space. Whether you work from the couch or run your business from a designated room, you should know the tax implications of setting up a home office and claiming the home office deduction. Does it raise your chance of […]

December 1, 2022

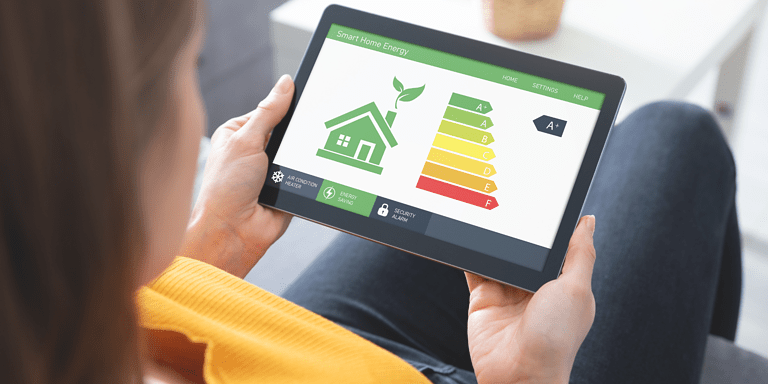

Tackling home improvements and reducing your tax bill at the same time? Sounds like a win-win! The recently passed Inflation Reduction Act includes expanded tax credits for energy-efficient home improvements, which some analysts have estimated could save over 100 million households $37 billion a year on their energy bills. The 2022 Inflation Reduction Act extended […]

November 29, 2022

Ongoing research and development (R&D) is a cornerstone of a prosperous economy, which is why the IRS provides a federal R&D tax credit under Internal Revenue Code Section 41. But the scope of R&D isn’t limited to large-scale scientific development (such as large pharmaceutical companies working on a new drug); small businesses also can and […]

November 22, 2022

Amid rampant inflation, the Great Resignation, economic uncertainty, and the new normal of the working world, many businesses will soon be adding another challenge to the list: higher tax bills brought about by changes to tax regulations. In this blog post, we take a closer look at some of the big tax changes on the […]

November 17, 2022

Individuals, small businesses, large businesses, and even governments are frequent targets of cyberattacks in the form of ransomware, phishing, stolen devices, malware, or insider theft. Typically, larger businesses have a department dedicated to maintaining a shield of protection from cyberattacks. Small businesses are perceived as an easier target by hackers because they tend to lack […]

November 16, 2022

IMPORTANT UPDATE: On November 10th, 2022, a court struck down the Biden-Harris Student Debt Relief Plan, and the administration has now stopped accepting applications for federal student loan forgiveness. The department says it will hold the applications of borrowers who have already applied. For now, borrowers should sit tight and wait to see what happens. […]

November 9, 2022

Operating a restaurant is challenging, with the industry reporting one of the highest failure rates. Even in the best of times, restaurants experience high turnover rates, notoriously low margins, and strict operational regulations. Over the past few years, restaurant failure rates shot up due to the pandemic, and restaurantaurs continue to face challenges even with […]

November 7, 2022

In the third quarter of 2022, the hottest topics were inflation, market swings, and what’s ahead for our economy. In our October 25th, 2022, economic update, we addressed these topics, as well as proposed legislation and what to expect in the upcoming tax season. We also discussed ways to protect your savings and how to […]

October 28, 2022

It’s no secret that being a business owner can be an incredible opportunity, while also presenting significant challenges on a daily basis. Business owners are battling many different fronts, from keeping employees and customers happy to keeping up with rising demand and the costs associated with doing business. This is especially true when an economic […]

October 27, 2022

The Employee Retention Tax Credit (ERTC), also known as the Employee Retention Credit (ERC), is one of the few significant COVID-19 relief options that could still be advantageous for eligible businesses. But the rollout of the ERC was complex and subject to significant changes, which led to the rise of questionable companies creating confusion among […]

October 21, 2022

When it comes to financial planning, saving for retirement is a top priority. When we picture our golden years, we hope to be able to enjoy financial freedom, live comfortably, and perhaps even provide for others after we’re gone. One of the most popular vehicles for people with earned income to save for retirement is […]

October 14, 2022

Data-driven decision-making: it’s more than just a buzzword. Businesses, both large and small, make decisions every day that can either propel them forward or set them back. In today’s economy, it’s vital to be agile, ready to anticipate potential issues, and take action at any given moment. Business owners have tools at their fingertips to […]

September 28, 2022

Do you have a clear picture of your business’s inventory? Oftentimes business owners will go far too long without reviewing inventory, only to find out it’s in desperate need of cleanup. While the year-end inventory count is a valuable internal control, only checking inventory once a year can lead to incorrect information accumulating over 12 […]

September 23, 2022

The word audit can send a business owner into a nervous panic. But an audit isn’t always a serious issue, especially when conducted internally. Yes, there are audits performed by the IRS if there is reason to believe that taxes have not been paid accurately. However, small business owners often don’t realize that they should […]

September 20, 2022

The Inflation Reduction Act of 2022 was signed into law by President Biden on August 16, 2022. In addition to new taxes and credits, the Act directs $80 billion to the Internal Revenue Service (IRS). In this blog post, we summarize the Act’s tax revenue provisions, tax credits and deductions, IRS provisions, and how your […]

September 9, 2022

Congratulations! You have a business idea and are in the process of getting the business up and running. While your to-do list might be a bit intimidating, don’t forget a small but vital decision to make when it comes to your back office: will you use the accrual or cash accounting method? It’s crucial to […]

September 7, 2022

2022 not your year for earning potential? Many of us are still feeling the effects of the pandemic reflected in our income, AND we now have inflation to deal with. Perhaps you’ve been forced to take a break from work due to personal circumstances, or maybe your business just hasn’t done that well this year. […]

August 29, 2022

Whether you’re running a business, handling your personal affairs, or both, there’s no escaping the need for some level of financial accounting, bookkeeping, financial planning, and tax preparation. For many people, handling these financial elements is, at best, a drag; at worst, a costly omission or mishap. Fortunately, there are people out there who specialize […]

August 26, 2022

While your product or service may be the heartbeat of the business, cash is the lifeline, and without adequate cash flow, your business health will decline quickly. There are many vital factors to monitor as a business owner, with cash flow topping the list. Unfortunately, lack of cash flow is the number one reason why […]

August 24, 2022

While building a successful family business takes a significant amount of time, effort and money, it can all come toppling down if you haven’t created a strong estate plan. According to PwC’s 10th Global Family Business Survey insights, family businesses make up more than half the world’s GDP and are massive contributors to social and […]

August 19, 2022

Although the terms ‘expenses’ and ‘assets’ are often used interchangeably in everyday language, they have different meanings and implications in accounting. From a tax and accounting perspective, the terms asset and expense both refer to anything your company purchases in order to do business. However, the similarities end there. Assets and expenses are accounted for […]

August 18, 2022

After months of negotiations, the Inflation Reduction Act of 2022 has been signed into law by President Biden. This act is a massive climate, healthcare, and tax bill that has the power to drive some real changes in our economy in the coming years. Here’s what we want our clients to know now. What is […]

August 12, 2022

Jacksonville-based CPA firm GunnChamberlain P.L. is now known as Financial Solution Advisors. Financial Solution Advisors (FSA) is a full-service accounting firm offering a comprehensive approach to business accounting, tax compliance, and strategic financial planning. The firm is led by CEO Shelly Lingor and Founding Partner Joel Chamberlain, along with CPA Partners Kenny Krey, Isaac Brohinsky, […]

August 10, 2022

This has been an interesting year for the markets and economy. There’s been a lot of change and volatility, but it’s nothing we haven’t seen before. In natural business cycles, companies will grow as demand grows. They’ll beef up supplies to meet anticipated demand and do more to capitalize or build more into their buildings […]

July 27, 2022

“More than 50% of Americans think that estate planning is at least somewhat important, but only 33% have a will or living trust.” – Caring.com Nobody likes to think about what will happen when they’re gone, but ensuring your estate is in order will help to prevent unnecessary family squabbles and reduce the tax burden […]

July 26, 2022

For companies looking to provide their employees with the tax benefits as a regular 401(k) plan without all the hassle, setting up a safe harbor 401(k) means they can skip the onerous annual testing requirements and expenses associated with nondiscrimination tests typically required for a traditional 401(k). In this article, we discuss the problems a […]

July 21, 2022

Once you’ve checked your tax return off the list for the year, it can be tempting to check out and enjoy your hard-earned income. As much as we’d all enjoy a long break from thinking about taxes, the truth is that it’s time to start tax planning for next year. By starting to plan now, […]

July 20, 2022

We may be in the heat of summer, but that doesn’t mean taxes are off-topic. In fact, summer is an ideal time to check in on your tax planning strategy and regular bookkeeping efforts. Proactive tax planning and preparation are key to a smooth tax season, ensuring you can take advantage of deductions and credits. […]

July 15, 2022

If you’re like many people, you put off filing your taxes until the due date is about to fall on your head. We get it—taxes can be a major source of stress, but they don’t have to be! With effective tax planning, you may be able to reduce your tax payable or secure a larger […]

July 14, 2022

Your home is probably one of the most significant purchases you’ll ever make in your life. It’s also one that comes with a lot of pride and emotion. Now, it’s time to sell. Of course, you want to make a profit, but what about the tax implications? Here’s what you should know if you’re selling […]

July 14, 2022

Given that the average annual cost (tuition, fees, and room and board) of college has increased 11% at public colleges and 14% at private colleges (over and above increases in the Consumer Price Index), it’s no surprise that college expenses can be overwhelming. In the 2021-2022 year, the average total cost of attendance for in-state […]

July 14, 2022

A budget is an essential part of any business. While developing the budget may sound daunting, it should really empower you as a business owner to make educated and informed decisions. Business budgets will help you prepare financially, relieve the stress of the unknown, and provide support in reaching your business goals. What exactly is […]

July 8, 2022

In the infancy stages, or as your business expands, research and development is a common business activity. Research and development can be an exciting time for a business, whether it’s creating the first product or improving your core business offering. For new business owners, research and development can be a bit confusing when it comes […]

June 29, 2022

If you have a product, ecommerce is a must. Whether your main focus is ecommerce or you’re using it as an extension of your core business, selling products online can be an incredible way to reach customers virtually anywhere. Before you launch an online store, you may want to take a minute to get acquainted […]

June 28, 2022

U.S. inflation continues to make headlines, with the most noticeable impact on the costs of real estate, fuel, and food prices. With inflation on the minds of consumers, our goal is to empower you to make informed decisions about your finances. Here is a quick primer on inflation, interest rates, and ways to safeguard your […]

June 23, 2022

Hiring employees can be a big step for a small business owner. Bringing on employees can help your business increase capacity and allows you to focus on your passions and expertise in the business. You may be hiring employees to focus on specific aspects of your business, such as sales, marketing, or product development—or simply […]

June 22, 2022

The child and dependent care tax credit helps to offset the cost of child or dependent care for families that pay for care while they work—whether that’s child care, summer camp, babysitting, adult day care, or another form of care for qualifying dependents. Over the years, the child and dependent care tax credit has undergone […]

June 16, 2022

It’s in the headlines and in the minds of every individual and business owner. Inflation. Rapidly rising costs and dwindling profit margins can leave small business owners in a difficult position. While inflation can take a toll on a small business, there are steps you can take to mitigate risks now and long term. What […]

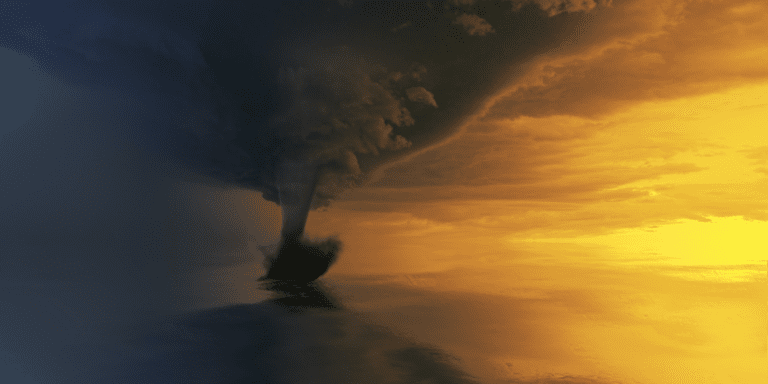

June 14, 2022

Every Floridian knows when the hurricane tracker tells you you’re in the “Cone of Uncertainty”, it’s time to read Tampa area Chief Meteorologist Denis Phillips’ seven hurricane rules. But what if Denis Phillips was a financial planner rather than a meteorologist? What would he say about the market? I imagine a calm, Denis Phillips-like financial […]